Talk to our Licensed Insurance and Investment Agent

Talk to our Licensed Insurance and Investment Agent

By far the most popular and well-known life insurance plan available in Canada.

Read MoreIt protects your family, helps you to save for your future and provides a peace of mind.

Read MoreA secure and flexible way of investing in the child's future, getting them a head start for tomorrow.

Read MoreIt provides lump sump tax free benefits when one of the covered medical condition is diagnosed.

Read MoreIt is designed to replace a portion of your income if you become disabled due to an injury or illness.

Read More

Vertex Insurance and Investments Inc. has been successfully meeting the needs of our customers since 2018. We’ve grown our successful Insurance Agency from the ground up, and accumulated years of experience to bring our clients complete peace of mind. As a full-service insurance agency built on the foundation of customer loyalty and trust, our aim is to develop long-term relationships with our clients to provide them with the support and guidance they need, no matter what life throws at them. Contact us to find out more about the high quality products and packages we offer.

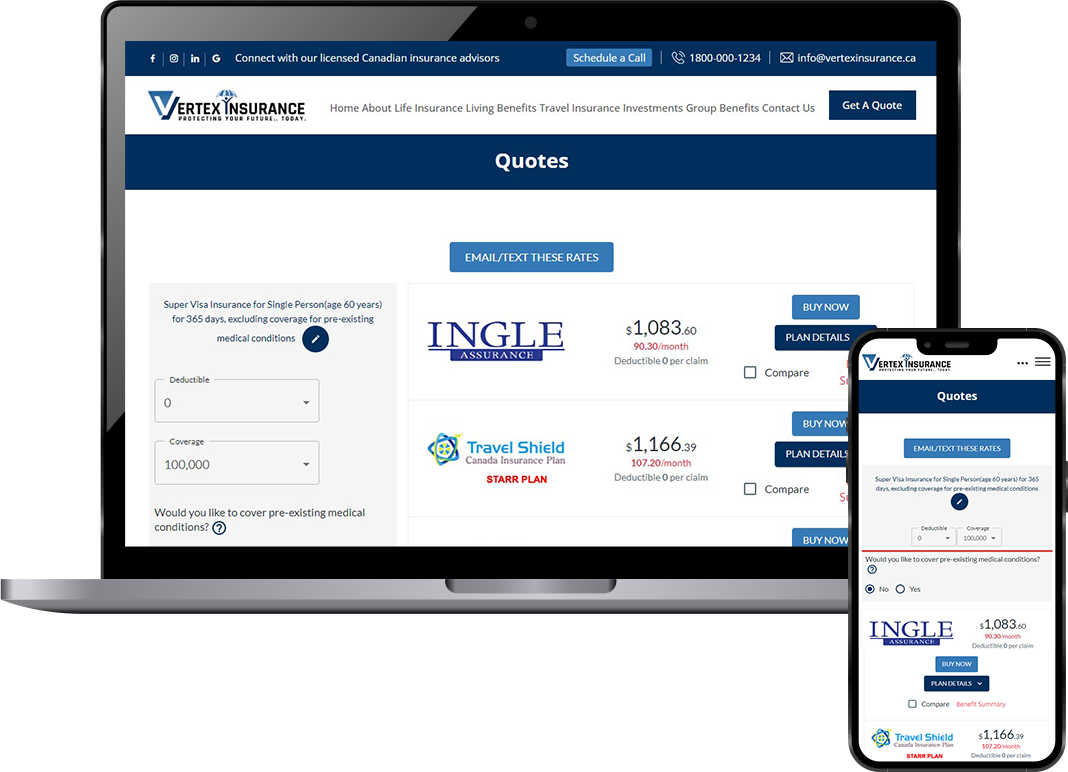

Compare Quotes With Top Canadian Life Insurance Providers

Call 1800-666-0483 to speak with our licensed insurance advisors right away or email us at info@vertexinsurance.ca to book an appointment.

If your family is financially dependent on you, they won't have to worry about paying their bills while you are away. Even your funeral costs can be covered by life insurance proceeds, saving your family from having to use credit or their own resources. Beneficiaries of life insurance receive payouts that are tax-free. Certain life insurance plans, including universal or whole life, might help you supplement your retirement savings.

The type of policy you choose, the amount of coverage, your age, whether you smoke, you may undergo a health assessment as part of the life insurance application process as well as your lifestyle and occupation—for example, whether you work in an industry with a lot of occupational hazards or if your hobbies include high-risk pursuits like skydiving and motorsport—are all factors.

A rider is an optional benefit or feature that you can include in your life insurance policy, usually for a fee. Life events that are not covered by your basic policy may be covered by riders. Overyour lifetime, riders may offer benefits for critical illness and more

Yes! No medical life insurance is a unique product, where you can qualify for without having to undergo a medical exam, or blood tests, has grown in popularity as a result of recent advances in the life insurance industry. You are only required to answer yes or no to health-related questions for qualification.

satisfied customers

of life insurance sold

help from the experts

years of experience team

We know that negotiating the world of insurance can be tricky, that’s why we work so hard to make sure our clients are always our top priority. Read on below to find out what our customers have to say about our customer service and insurance expertise.

Vertex Insurance advisors could answer all my questions. They had the knowledge of every question that I had put. I got an answer which you know, kind of satisfied what I was looking for.

Mother, Sr. Marine Underwriter and Vertex Insurance Customer